Thailand Fisheries Overview

Thailand Fisheries Supply Chain 2021

Stage : 1

Wild Capture

Wild Capture

Commercial

10,595 Vessels

162,800 Workers

61,150 Thai

101,650 Foreigner

Artisanal

51,237 Vessels

102,474 Workers

AquaCulture

AquaCulture

Domestic Aquaculturer

558,345 Personal

Annual Productivity

Aquaculture

1.00 MillionTons

Wild Capture

1.41 MillionTons

Import

2.12 MillionTons

Thailand Most Import Good

Fresh, Frozen Tuna 684,374 Tons

Fresh, Frozen Fish 788,142 Tons

Fresh, Frozen Squid 178,254 Tons

Fresh, Frozen fish fillet 108,574 Tons

Asean 31.17%

Asean 31.17%

China 9.14%

China 9.14%

Taiwan 6.83%

Taiwan 6.83%

Japan 6.18%

Japan 6.18%

Micronesia 5.33%

South America 5.33%

Stage : 2

Port / Market

Port / Market

Fish Market

Fish Market

23 Location

State Enterprises

Fishing Port

Fishing Port

1,157 Location

Sanitation Checked

Middle man

Middle man

6,579 Marine Trader

Anti IUU Registed

Fisheries Worker

Fisheries Worker

122,942 Thai

113,484 Foreigner

Total 236,426

Factory

Factory

Factory Certification

GMP

GMP

HACPP

HACPP

Laboratory Certification

ISO/IEC 17025

ISO/IEC 17020

ISO Guide 65

Certified Factory

54 Canned Factories

20 Fish Sauce Factories

41 Fish meal Factories

77 Frozen Factories

Stage : 3

Comsumption

Comsumption

Vol. 2,495,070 Tons

37.46 Kg/Person/Year

Export

Export

Vol. 1,557,201 Tons

Value 5,331 M-USD

Export Proportion by Value

Canned Tuna 28.79%

(1,534 M-USD)

Shrimp 25.54%

(1,361 M-USD)

Other prepare fishery 5%

(283 M-USD)

Petfood Canned 4%

(391 M-USD)

Export Proportion by Country

USD 22.54%

USD 22.54%

Japan 18.14%

Japan 18.14%

Asean 9.92%

Asean 9.92%

China 8.39%

China 8.39%

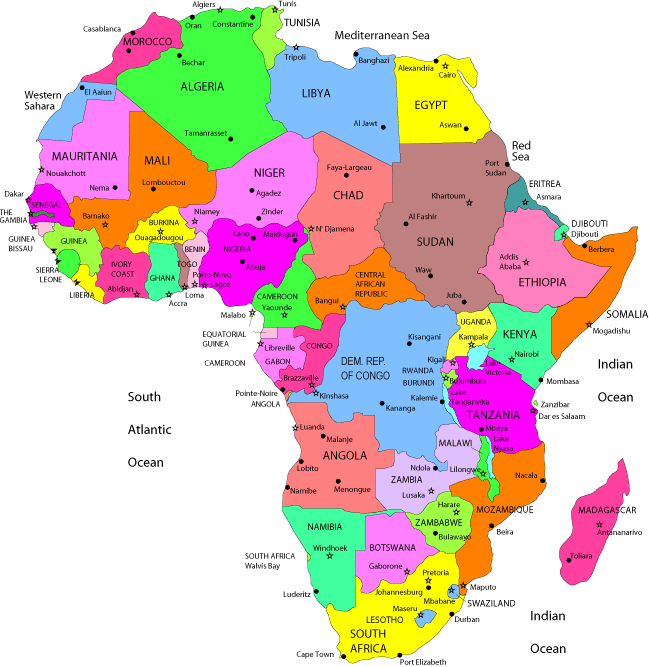

Africa 6.33%

Africa 6.33%